Date: 12/03/2024

Rising demand propels enterprise SSD prices to new records in Q4 202

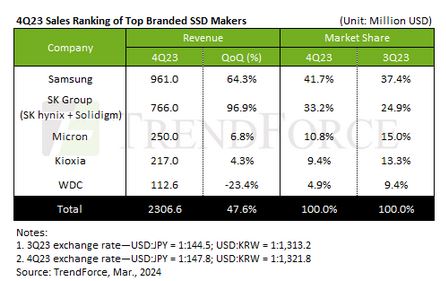

TrendForce finds fourth-quarter 2023 enterprise SSD prices soared by over 15%, driven by increased demand and capacity shortages, leading to a staggering 47.6% quarter-on-quarter revenue growth, reaching approximately $23.1 billion.

The enterprise SSD market witnessed a remarkable turnaround in the fourth quarter of 2023, as suppliers curtailed production, driving prices upwards. This surge in demand, fueled by robust buying activity from server brands and various end products, resulted in a significant increase in contract prices and industry revenues. As we enter the new year, the momentum from server brand orders continues to escalate, setting the stage for continued fervor in the market.

Further findings reported by TrendForce includes:

Expectations of a further 25% increase in contract prices are anticipated to fuel a 20% revenue growth in the first quarter of the new year, highlighting the sustained momentum in the market.

SK Group led the growth charge in the enterprise SSD segment, with revenues jumping by 96.9% to $766 million, driven by renewed stocking demand from key North American clients.

Samsung secured the second-highest growth at 64.3%, reaching $961 million, propelled by reduced production and revitalized order dynamics.

Micron experienced a 6.8% rise in revenues to $250 million, driven by contract price hikes in Q4, while Kioxia capitalized on growing PCIe 4.0 shipments, recording a 4.3% revenue increase.

Western Digital faced a downturn with a 23.4% decline in revenues to $113 million, attributed to diminishing demand for flagship products and strategic shifts towards client SSD development.

Tweet Follow @ecewire