Date: 31/01/2024

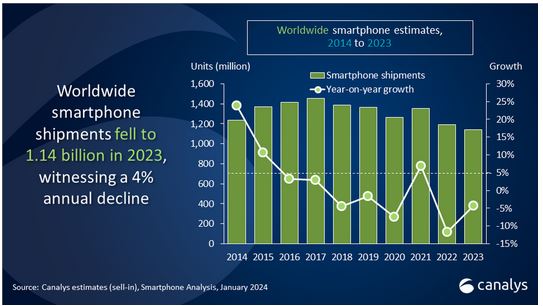

Global smartphone market declined just 4% in 2023 amid signs of stabilization

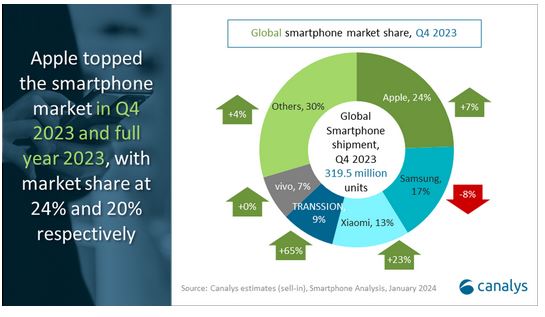

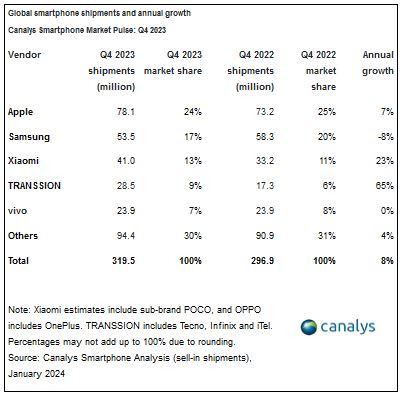

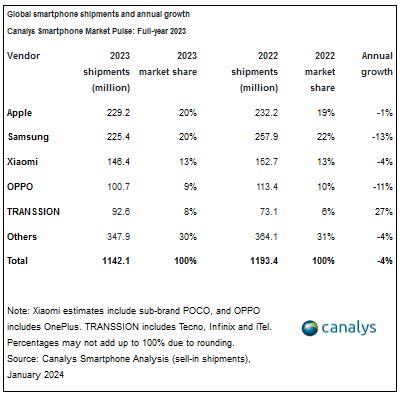

According to Canalys research, the global smartphone market experienced an 8% year-on-year growth in Q4 2023, reaching 319.5 million units, further indicating signs of stabilization and recovery. Total shipments for the full year 2023 amounted to 1.14 billion units, marking a 4% decline compared to 2022. Despite facing challenges in core markets, Apple claimed the top position for the first time with a 20% market share and 229.2 million shipments in 2023. Samsung followed closely, maintaining profitability as its strategy, shipping 225.4 million units and capturing a 20% market share. Xiaomi solidified its third position, holding a 13% market share with shipments totaling 146.4 million units. OPPO and TRANSSION ranked fourth and fifth, with 9% and 8% market shares, respectively.

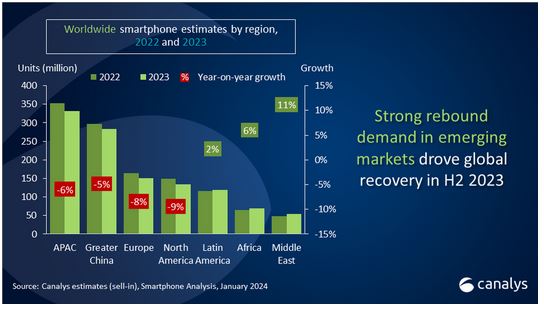

“The recovery in emerging markets led to a rebound in the second half of 2023, narrowing the decline,” commented Sanyam Chaurasia, Senior Analyst at Canalys. “Benefiting from additional strategic focus and resources from vendors who launched a slew of mass-market models, Latin America, Africa and the Middle East showed strong recovery momentum from Q3 2023 onward. Meanwhile, as macroeconomic conditions improved in the APAC region, consumer demand significantly increased toward the end of the year. TRANSSION and Xiaomi have benefited from these strong mass-market rebounds, achieving remarkable year-on-year growth in the fourth quarter. However, mature markets, including Mainland China, Europe and North America, still face strong headwinds due to subdued consumer spending and reduced channel investments. In 2024, emerging markets will remain a strategic battleground for most smartphone vendors seeking growth.”

“Smartphone vendors witnessed a significant profitability improvement despite the market declining in 2023,” remarked Toby Zhu, Senior Analyst at Canalys. “Vendors have been cautious with their business operations by streamlining expenses and focusing on their key markets in response to the market downturn. Meanwhile, the overall inventory backlog was largely reduced in H1 2023, elevating the operating pressures for vendors to clear inventory. Lastly, components and chipset prices were relatively low over the past year, allowing vendors to increase profit margins and develop competitive products. Vendors feel more confident financially in capturing any nascent demand and supporting more flexible incentive measures.”

“Investing in on-device AI for the high-end segment and expanding shipments in mid-to-low-end segments will become two strategic directions for smartphone vendors in 2024,” said Zhu. “AI will span from product level differentiation to operational and corporate strategy, varying across companies. Samsung will incorporate generative AI in its long-term product strategy. At the same time, Chinese vendors such as Xiaomi, vivo, OPPO and HONOR have already released flagship devices with gen AI capabilities in their home markets. (see Canalys' previous reports for AI-related insights). On the other hand, vendors will continue to focus on increasing volume and scales to maintain their wallet share and priority level in retail channels and supply chains even in the volatile environment. The mass-market segment will be the center for vendors, while value-for-money proposition and affordability are core product strategies in the short term.”

Source: Canalys

Tweet Follow @ecewire