Date: 26/12/2023

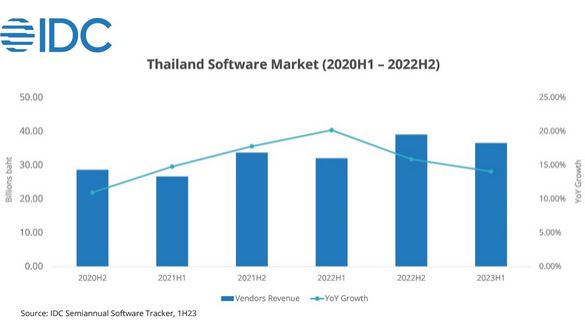

IDC: Thailand Software Market Surge in 1H23 Generates 36.5 Billion THB Revenue, a 14.1% YoY Growth

Software vendor revenue in Thailand hits 36.5 billion THB in 1H2023, grew by 14.1% Year-over-Year (YoY) in local currency in 1H23, according to International Data Corporationís (IDC) Worldwide Semiannual Software Tracker 1H2023. Key growth areas include artificial intelligence platforms, application platforms, and integration and orchestration middleware.

The tech world has increasingly focused on GenAI due to its proven capabilities, sparking interest from numerous enterprises to integrate AI technologies. This shift has motivated technology vendors to invest heavily in AI development, leading to rapid advancements in the field. These improvements in AI foundational models, along with availability of more accessible AI tools, are paving the way for the proliferation of AI-enabled applications. As a result, software vendor revenue in the AI platform market grew by 58.8% YoY in local currency in 1H2023.

One example of AI-enabled application adoption in 1H23 is the partnership between AstraZeneca Thailand and Phyathai 2 Hospital, which utilizes AI-based technology for chest X-rays to improve lung cancer screening capabilities. However, concerns regarding AI ethics have emerged in conjunction with AI adoption. To address these concerns, the Thai government launched the AI Governance Clinic (AIGC) and drafted the AI Ethics Guideline with the assistance of Mahidol University and Microsoft Thailand. These initiatives aim to provide Thai organizations with a framework for responsible AI adoption.

"The development of numerous LLMs in 1H23 has fueled the adoption of NLP applications like chatbots, text generation, and summarization. Yet, Thai-language LLMs are still behind in accuracy compared to English-language LLMs. This highlights an opportunity for Thai AI vendors to create more culturally attuned Thai-language LLMs, meeting the specific demands of local organizations," says Kavisara Korkong, Market Analyst at IDC Thailand.

IDC expects to see continuous natural language processing (NLP) development for local languages, along with availability of more AI software services for local businesses aligned with responsible AI principles, resulted in broader AI adoption in Thailand aided by government efforts and AI benefits.

In the area of customer experience (CX), in the near-term (2024-2026) the focus would be on the value AI holds in terms of real-time contextual conversational capabilities while in the longer term (2027-2029), there will be emphasis on edge analytics, shift from numerous point solutions to unified platforms, CDPs as the driving engine for better customer insights, improving customer trust, and value parity.

In recent years, Thai businesses have navigated a challenging landscape marked with high inflation, rising interest rates, geopolitical tensions, supply chain disruptions, economic slowdowns, and shifting customer behaviors. These factors have reshaped the business outlook, compelling organizations to adapt and embrace digital transformation to ensure resilience and maintain competitiveness amidst rapidly evolving market dynamics.

As Thai organizations embark on their digital journeys, they are increasingly recognizing the transformative power of digital modernization, leading them to create applications that streamline business operations, enhance customer experiences, and ultimately deliver a competitive edge. Application platforms play a pivotal role in this application development, providing a cohesive execution environment for applications. Noticeably, software vendor revenue in the application platforms market grew by 29.9% YoY in local currency in 1H2023.

According to the International Data Corporationís (IDC) Worldwide Semiannual Software Tracker 1H2023, the proportion of revenue from the public cloud surpassed that of on-premises and private cloud. IDC expects that large enterprises, traditionally reliant on on-premises solutions, will increasingly consider hybrid strategies, opting to operate some application platform workloads in the cloud due to its scalability and flexibility, while also choosing to maintain on-premises and private cloud operations for enhanced security measures.

In addition to application platforms, integration and orchestration software experienced notable growth in 1H2023, evident in the 25.3% YoY increase in software vendor revenue in the integration and orchestration software market, measured in local currency. As Thai organizations embark on their digital transformation (DX) journeys, they have the capability to integrate digital systems across the organization, aligning with their digital transformation strategies. The management of IT environments, along with the task of ensuring synchronization among data, processes, and applications across the organization, has grown increasingly complex. Integration and orchestration software plays a pivotal role in managing these intricate IT environments, facilitating seamless integration and orchestration of disparate systems and processes, ultimately contributing to the success of DX initiatives.

To know more about the IDC Worldwide Semiannual Software Tracker, please contact Kavisara Korkong at kkorkong@idc.com. For media inquiries, please contact Fenny Tjandradinata at ftjandradinata@idc.com or Jane Yap at jyap@idc.com.

Source:IDC

Tweet Follow @ecewire