Date: 26/12/2023

Canalys expects Mainland China's PC market to grow from Q2 2024

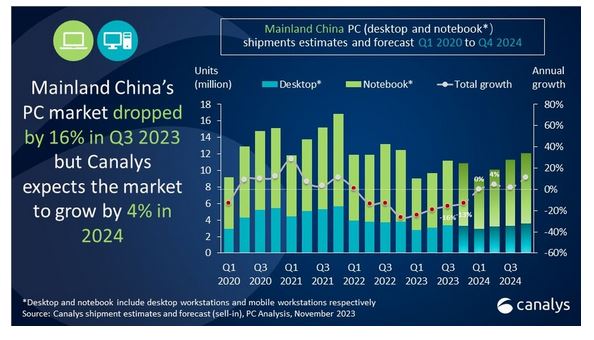

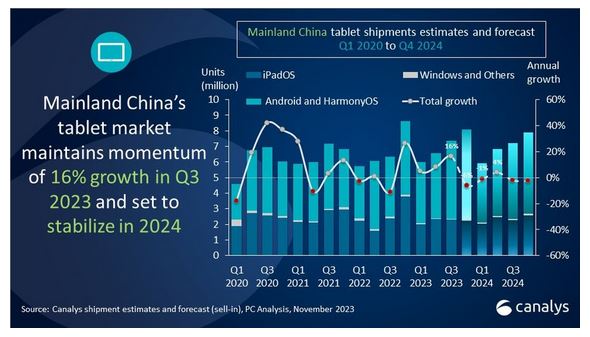

In Q3 2023, the PC (desktops, notebooks and workstations) market in Mainland China gradually recovered, with shipments experiencing a 16% year-on-year decline but undergoing a promising 15% sequential increase to reach 11 million units. Desktops (including desktop workstations) spearheaded the rebound with a marginal 9% decrease to 3.4 million units, while notebook (including mobile workstations) shipments dropped by 18% year-on-year to 7.8 million units, reflecting lingering weakness in end-consumer demand. In contrast, the tablet market sustained positive momentum, recording a 16% year-on-year growth to 7.4 million units, fueled by seasonal promotions and digitalization in education and entertainment.

Mainland China PC Market Q3 2023

Canalys projects a year-end decline of 18% in Mainland China's PC market (excluding tablets) in 2023 and a modest 4% growth in 2024. The growth is expected to materialize in Q2 2024 and beyond, benefiting from the further recovery of the commercial sector, driven by significant IT investments from large enterprises in strategic industries.

“IT investment from enterprises is only improving marginally alongside the overall Chinese economy recovery, while SMBs still face many operational challenges,” said Emma Xu, Analyst at Canalys. “There are signs of growth in public sectors and frontier industries with IT upgrade demands set for AI solutions. According to the latest central government economic discussion panel, as the primary economic focus of 2024 is shifting to encouraging industrial upgrades from domestic consumption, advanced IT investment is expected to be a beneficial factor for tech industries and vendors.”

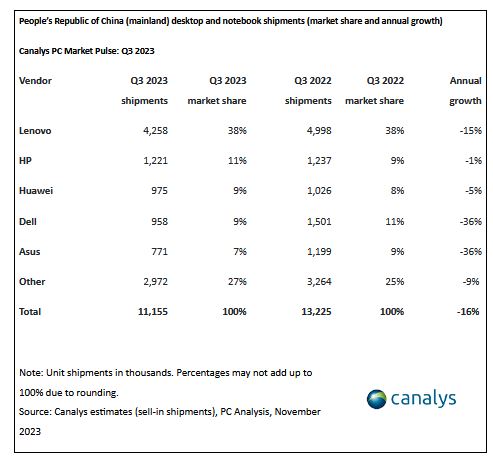

In Q3 2023, Lenovo maintained its top position despite a 15% year-on-year decline in the PC shipments. HP took the second position with an 11% market share as the vendor strengthened its commercial product portfolio offerings with its acquisition of Poly. Huawei increased its market share despite a 5% unit drop year-on-year. Dell and Asus secured the fourth and fifth positions, respectively, though both encountered a substantial 36% year-on-year decline.

Mainland China Tablet Market Q3 2023

In the tablet market, Canalys anticipates a 5% growth for the full year 2023, reaching 28 million units before it stabilizes in 2024. The continuous digitalization trends in learning and working are a driving force for tablet expansion, enabling usage in various life scenarios, including home, school and business environments. “The demand for smart products that make life more convenient and efficient will continue to be strong in Mainland China as leading vendors are anchoring their growth in driving upgrades in specific user scenarios such as parental education or creative work and investing in constructing entire product ecosystems with embedded interoperable functionalities,” added Xu.

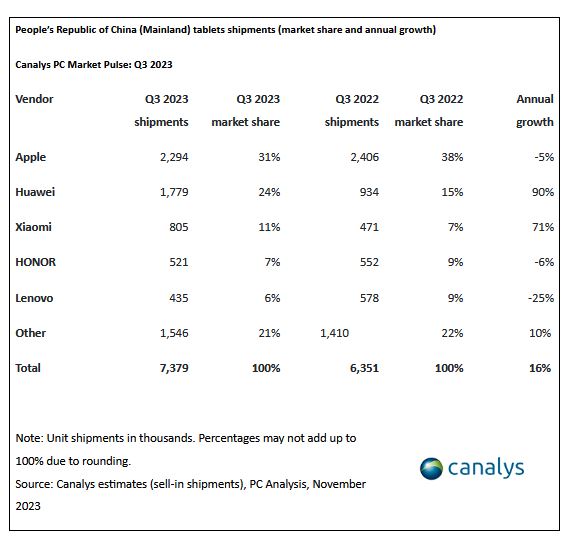

Apple and Huawei maintained their dominance, with Apple's market share contracting to 31% from 38%. Huawei's market share increased to 24%, driven by proactive product marketing and channel promotion. Xiaomi experienced growth, with its tablet market share expanding from 7% in Q3 2022 to 11%. HONOR and Lenovo completed the top five, although both experienced declines in both market share and shipments.

People’s Republic of China (mainland) desktop and notebook shipments (market share and annual growth)

Canalys PC Market Pulse: Q3 2023

People’s Republic of China (Mainland) tablets shipments (market share and annual growth)

For more information, please contact:

Emma Xu: emma_xu@canalys.com

Source:Canalys

Tweet Follow @ecewire