Date: 08/09/2023

Optical transceiver market to grow by 12% CAGR from 2022-28 to reach US$22.3 billion

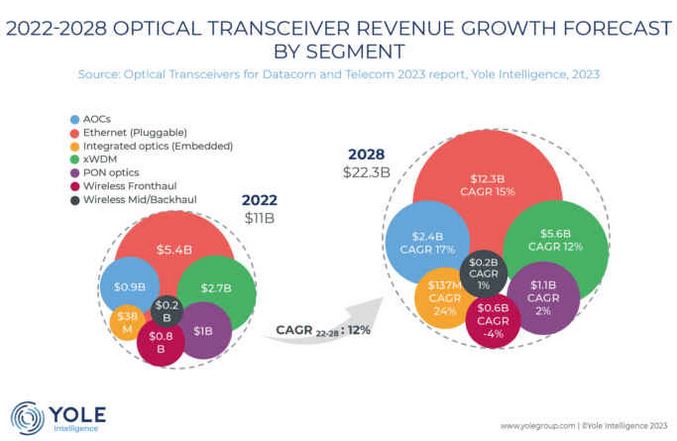

The demand for AI powered data centers is rising and so is the rise semiconductors for this industry. Yole reported optical transceiver market to double to US$22.3 billion in 2028 at 12% CAGR between 2022-2028, led by Chinese suppliers and driven by power-efficient technologies. Chinese vendors lead in this area.

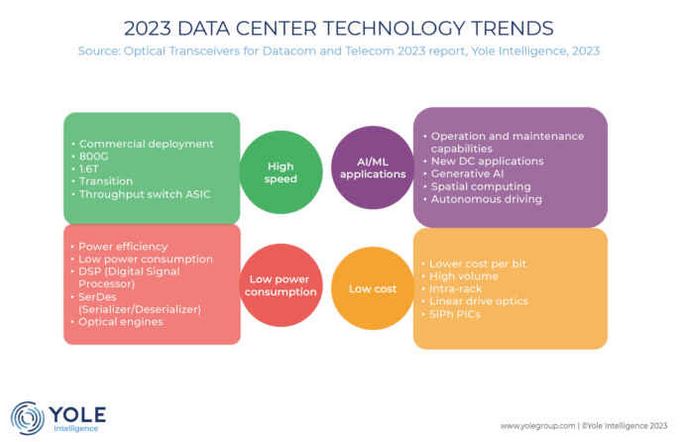

Generative AI more deeply into everyday life applications increasing the number of users of this tech and so is heat generated by these servers.

Others driving this market as per Yole Intelligence includes applications such as UHD video, AR/VR applications and cloud services – social networking, business meetings, video streaming in UHD, e-commerce, and gaming applications, that will continue to drive growth.

Martin Vallo, Ph.D., Senior Analyst, Photonics at Yole Intelligence said “In this dynamic context, revenue generated by the optical transceiver market increased 19.3%, from US$9.8 billion in 2021 to US$11 billion in 2022. It is expected to reach US$22.3 billion in 2028 at a 12% CAGR for 2022-2028. This growth is driven by high demand for 800G high-data-rate modules by big cloud service operators and CSP s requiring increased fiber-optic network capacity.”

In its 2023 report, Yole Intelligence’s analysts describe the competitive landscape and give a relevant overview of the supply chain. The global optical transceiver industry is highly competitive, with players ranging from large international companies offering a broad portfolio of products to smaller companies specializing in narrow markets. The key competitive factors in the optical transceiver market are the ability to provide leading-edge technologies for high-speed communications and to design and manufacture high-quality, reliable products, including customized solutions. Different techniques and approaches can be used to overcome physical limits to achieve higher data rates. It is also evident that the two competing strategies based on the InP and the silicon photonics platforms will coexist during the coming years as leading players are linked with both platforms.

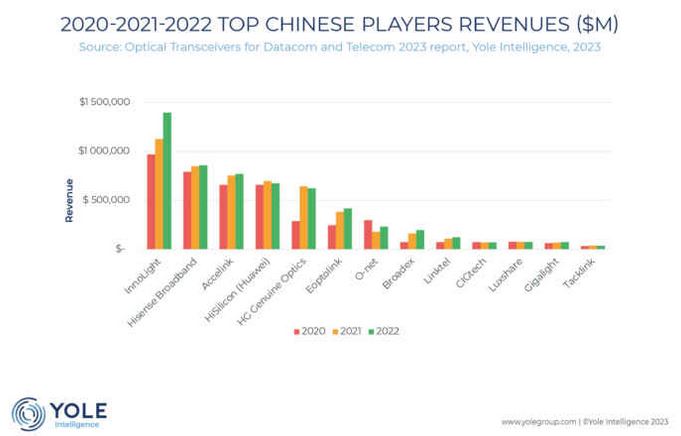

Eric Mounier, Ph.D., Fellow Analyst at Yole Intelligence said “Under its continuous catch-up and accelerated development program, China is taking an increasingly prominent position in the optical communication industry. Nowadays, the core optical technology for high-speed modules is the domain of American and Japanese manufacturers, but China has invested heavily in photonic manufacturing platforms – GaAs , InP, and SiPh .”

The Chinese government’s program – the Roadmap for the Development of the Optical Device Industry (2018-2022) – defined a national strategy to increase the market share of local producers of optical chips. The China-US trade restrictions and ZTE’s ban may prompt China to increase its support for high-speed optical chips, and domestic optical chip production is expected to accelerate further…

News Source: Yole

Tweet Follow @ecewire